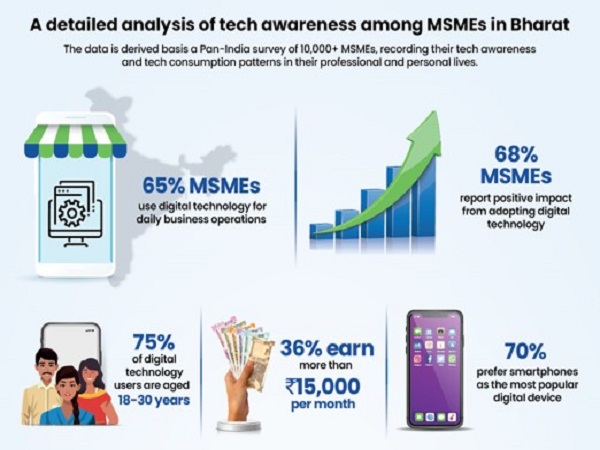

The MSME sector in India has experienced significant growth in adopting technology recently, driven by a notable shift in small business owners’ perspectives. According to PayNearby’s ‘MSME Digital Index 2024,’ a Pan-India report detailing technology consumption by MSMEs at the grassroots level, over 65% of Micro, Small, and Medium Enterprises (MSMEs) utilize some form of…