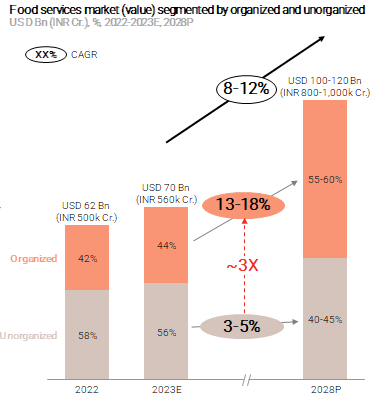

India is undergoing a discernible transformation in dining habits, characterized by a notable uptick in the patronage of dining establishments beyond the confines of one’s home. This trend is particularly pronounced across diverse age groups in metropolitan areas and Tier-1 urban centers. Consequently, projections indicate that India’s food service market is poised to exceed $100 billion in revenue by 2028, primarily driven by the accelerated expansion of the organized sector. This sector is anticipated to surpass the growth rate of the unorganized segment by a significant factor of three.

Outside eating is evolving

According to the latest report titled “Winning Recipe for Food Brands in India” by Redseer Strategy Consultants, dining out has become a customary practice rather than an occasional indulgence for urban Indians residing in metropolitan and Tier 1 cities. This shift is underscored by a notable surge in the frequency of dining out, with a 30% increase observed among students and young adults, and a 20% increase among mid-lifers compared to figures from 2018.

The report identifies a growing demand for variety and an increased focus on quality among consumers. This trend is compelling both established brands and emerging players to actively participate in the culinary market landscape. “Brands are also leveraging this opportunity and scaling their presence in the India market, which is expected to drive the organized food services market from $30 billion to $60 billion by 2028,” says the report.

Brands need to tap into multiple cuisines

The Indian culinary landscape boasts a remarkable diversity, with discerning tastes that vary widely across regions. This diversity is very evident in the Biryani category, which features a myriad of regional variations such as Lucknowi, Kolkata, Ambur, and Hyderabadi, each reflecting the rich culinary heritage of India.

However, this diversity also poses challenges for standalone brands aiming to scale their operations beyond a certain threshold. “The Total Addressable Market (TAM) for a particular cuisine, such as biryani, may be limited within a single city or region despite the vast potential of the overall market. In a typical metro city, the organized market size for biryani might range from INR 800-1,200 crore within a larger INR 20,000-30,000 crore category,” says the Redseer report.

As per the report, “For brands operating solely within a single metro city and focusing on a specific cuisine, achieving a revenue target of INR 100 crore becomes particularly challenging. To reach this target, a standalone brand must capture a significant market share, typically ranging from 10-15%. This presents a formidable hurdle for brands seeking to establish themselves in the competitive culinary market.”

The House of Brands advantage

Amidst the formidable challenge of securing significant market share faced by standalone brands, the House of Brands (HoBs) strategy has emerged as a highly effective approach for scaling food brands in the Indian market. HoBs, which encompass multiple brands spanning diverse cuisines under a unified entity, exhibit average revenue that exceeds fivefold that of standalone brands.

This heightened revenue performance is attributed, in part, to the expansive reach of HoBs across various cuisines and meal slots, allowing them to tap into a larger Total Addressable Market (TAM). Additionally, the strategic sharing of resources within the HoB framework enhances kitchen utilization rates and fosters improved operating leverage, resulting in reduced Costs of Goods Sold (COGS). These synergistic advantages fortify the competitive position of HoBs within the market landscape.

According to the Redseer report, “Successful House of Brands are characterized by their focus on two critical aspects. Firstly, their ability to build and scale multiple brands across diverse cuisines, thereby capturing higher revenue potential rather than being dependent on their anchor brand. Secondly, driving operational excellence through measured geographic expansion, strong consumer funnel and optimized capital & operational expenditures.”

Rohan Agarwal, Partner, Redseer, observes: “Indian food market will need lot more of mid-sized brands than fewer mega brands owing to the diversity it brings. House of Brands playbook has been successful in this context. It is particularly heartening to witness the new-age homegrown house of brands leading the charge by building multiple sizable brands already.”