E-commerce is set to witness a significant boom by 2026, with the demand expected to come from semi-urban and rural areas. Assisted e-commerce is one such category that is gaining popularity among Bharat consumers. This growth is also indicated in a data report released by PayNearby, India’s branchless banking and digital network.

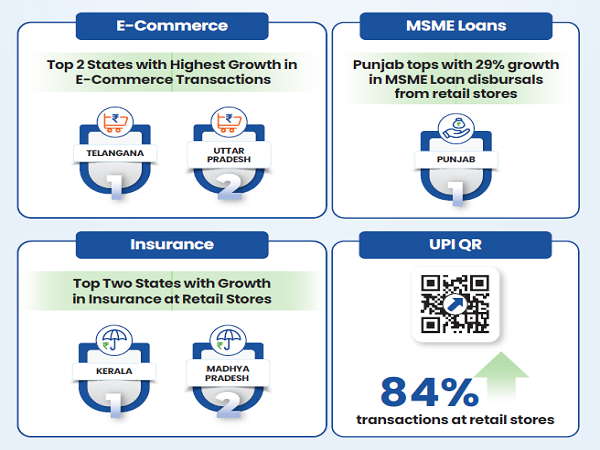

Local retailers and kiranas in Telangana and Uttar Pradesh witnessed the highest growth in assisted e-commerce transactions, recording more than 1100% and 164% increases respectively. The PayNearby’s report titled ‘Atmanirbhar Bharat Digital Empowerment’ highlights the growing acceptance of assisted financial and digital services at semi-urban and rural retail stores such as Kirana stores, medical stores, and mobile recharge stores.

Some of the popular categories in the e-commerce segment and branded shops segment include grocery, mobile & accessories, and clothes. The average ticket size in the e-commerce and branded shop categories was INR 1,500 and INR 3,000 respectively.

Anand Kumar Bajaj, Founder, MD &CEO, PayNearby, said, “Rural commerce is undergoing a significant shift with aspirational customers getting access to various products at a nearby store. At PayNearby, we are leveraging the Distribution-as-a-Service (DaaS) architecture so that the customers can embrace the e-commerce revolution with superior experience, local retailers have enhanced income opportunities and e-commerce partners can expand their footprint, even to the remotest of areas. We are dedicated to empowering local retailers and ensuring that essential digital and financial services are accessible to everyone and everywhere.’’

The report further highlights the growing reliance on and trust in local retail stores to provide essential financial services such as cash withdrawals, deposits, credit, and insurance. Notably, Assam led with an increase in the number of retailers offering financial services and growth in overall transaction volumes at retail stores.

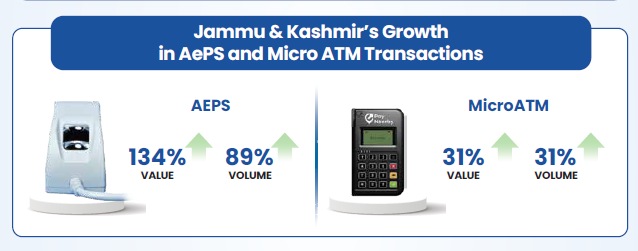

Moreover, the adoption of AePS and Micro ATM services at retail stores in Jammu &Kashmir and Northeastern states further provides a boost to the Government’s vision of a ‘Viksit’ Bharat. While adoption saw over 134% growth in value and 89% in volume of transactions at retail stores in J&K, there was a 31% rise in Micro ATM transactions in the region.

Similar trends are observed in Northeastern states, with Meghalaya witnessing a staggering 1000% growth in AePS transaction value and a 712% increase in transactions. This is followed by Nagaland and Assam, both of which also demonstrated impressive growth in AePS transaction value and the number of transactions. Furthermore, Punjab has witnessed the highest growth in disbursing MSME loans through retail stores, with a notable 29% increase. Insurance disbursals through retail stores also saw a significant uptick, with Kerala and Madhya Pradesh recording 24% and 14% increase, respectively.

Additionally, the report indicates a strong shift towards digital payments with the transactions on UPI QR codes at retail outlets growing by 84%.

The report has been prepared based on transactions across 12 lakhs plus retail touchpoints throughout the country. The findings of the report are based on business data collected for a comparison period, ranging from FY 2023-24 vis-à-vis the corresponding previous financial year.