India’s F&G retail sector, valued at USD 730 billion, is rapidly growing through online retail’s convenience and tech advances. Key platforms like Blinkit, Zepto, Bigbasket, and JioMart aim to expand efficiently and exponentially leveraging tech trends. Opportunities lie in diversification, new market targeting, and robust supply chains, positioning the sector for sustained growth, ensuring convenience, variety, and post-pandemic reliability.

Food and Grocery (F&G) constitutes the largest segment within the retail sector in India, encompassing a significant two-thirds of the total retail expenditure and a market size of USD 730 billion in 2023. Growing at a rate of 8-8.5% per annum the market is expected to cross a trillion dollars by 2027.

This growth can be attributed to various factors. These include the persistent increase in per capita income, the ongoing urbanization process, the rise in nuclear families, the shift from unpackaged to packaged foods leading to price increases, and a noticeable inclination towards premiumization.

Regarding categories, staples and fresh products remain the primary players in food retail, making up roughly 75-80% of the total consumer expenditure on Food and Grocery (F&G). However, emerging categories like packaged snacks, confectionery, and beverages are experiencing significant growth, with a compounded annual rate of 15-16%, nearly twice the overall F&G category growth rate.

“Convenience” is one of the biggest trends shaping the market, especially in the mid to premium segment, and it is changing not just what we eat, but also how we shop. Convenience foods including snacking items, ready-to-cook & ready-to-eat products, beverages etc. are taking more shelf space both in retail stores as well as our kitchens.

When it comes to retail channels, convenience-oriented formats are not only increasing their market share but also driving the expansion of the Food and Grocery (F&G) retail market.

Further, it is worth noting that changing lifestyles, shopping habits, and aspirations have significantly influenced customer behavior, leading to a notable shift towards modern retail outlets for purchasing grocery items, as opposed to frequenting traditional kiranas.

In fact, driven by this trend, familyowned traditional kirana stores have also started modernizing their layouts and displays and wherever possible making the stores selfserviced. While almost all stores in urban areas have started home deliveries, many local retail chains have also launched their apps and are partnering with online aggregators to increase their sales.

These online F&G stores/platforms witnessed a substantial surge in demand during the COVID-19 pandemic due to the closure of physical stores and restrictions on the number of customers they could serve. During the initial lockdown in 2020, this segment experienced a remarkable 75% growth

Categories such as FMCG and Fresh, particularly fruits and vegetables, witnessed an impressive 145- 150% increase in monthly sales. As the impact of COVID-19 gradually diminished in the following years, consumers embraced the comfort and convenience offered by online F&G platforms and quick commerce providers, leading to a sustained preference for online shopping.

These online retail channels for Food and Grocery (F&G) are poised to further expand their reach and boost sales. Time-strapped consumers prefer the convenience of last-minute shopping, avoiding the need for monthly or fortnightly grocery planning and trips to physical stores.

Changing Landscape of the F&G Retail Market

The F&G retail market currently consists of three key segments namely, Traditional or Unorganized retail, Organized or Modern retail, and Online retail.

Traditional or Unorganized Retail constitutes the largest assortment of retail establishments in India, amounting to approximately 12.8 million in total, covering about 93% of the total F&G market in value terms. These establishments typically span from 100 to 1,000 square feet, with the majority falling under the 500 square feet range. These stores typically cater to the quirks of the local folks, offering personalized and customized service, providing flexible credit options, and making home

deliveries for customers. The number of traditional grocery stores in India has witnessed a consistent growth over the last 10 years, experiencing a slight decline in 2020, attributed to the unprecedented COVID-19 pandemic. However, in 2021, the figure made a recovery, reaching a count of 12.8 million.

Organized or Modern Retail is the second most important segment for F&G retail. This segment started growing in the mid-2000s and remained extremely buoyant and competitive till 2019 (pre-COVID days). The segment is engaged in intense competition, as major contenders strive to captivate consumers with alluring deals, offering well-stocked shelves in pristine, brightly lit ambiance, and showcasing a vast assortment of products.

As of 2021, supermarkets reigned supreme within modern retail, comprising approximately 49% of the market share, closely followed by convenience stores at 43%, with hypermarkets trailing at 8%. The non-discretionary nature of F&G demand kept the segment resilient even during the peak pandemic in fiscal year 2021, when revenue fell only 3%.

The segment currently contributes to about 6% of the total F&G market and is expected to reach a substantial USD 60 billion by the year 2025, contributing to about 7% of the market.

The penetration of modern retail has remained fairly low in India, as compared to most other Asian countries, e.g. in China modern retail contributed to 57% of total F&G retail. A key reason for this is that modern retail in India is still a very “big city” thing and penetration is limited to a few Metros, Tier 1 & 2 cities, because of operational and other reasons.

Given that F&G is traditionally a low margin business and the cost of retail in India is fairly high, the modern F&G retail formats have always been under pressure. Further, while consumers like the glitz of shopping in large supermarkets and hypermarkets, once in a while, Indian consumers crave for convenience which these formats are not able to provide.

Hence like in many other sectors in India, the market seems to have leapfrogged to the next format/ sector i.e.; online F&G retail, even though the modern retail formats remain in an evolving stage in India. Also, most modern retail stores have now launched their online sales channel through apps as this helps them leverage their already existent brand recall, customer base, physical stores and warehousing infrastructure, inventory, and other assets.

Online Retail is the newest kid on the block and the flavor of the season for F&G retail, largely driven by quick commerce players like Blinkit, Zepto, BigBasket now, etc,. Unlike most other categories, F&G for a very

long time remained insulated from the e-commerce revolution, given the high penetration of unorganized and organized stores with delivery facilities, and the unit economics for low margin F&G products being not very lucrative for the online channel. However, COVID 19 changed the game as orders on online platforms surged by three to four times and average order values also increased by about 25%.

In the year 2022, the online F&G market in India was estimated to be worth USD 6.8 billion, which is less than 1% share of the overall F&G market. Projections based on diverse statistical data indicate a remarkable growth trajectory, with the market expected to skyrocket to an astounding USD 37 billion by 2028, contributing to about 3.5% of the overall F&G market.

This forecast indicates an exceptional Compound Annual Growth Rate (CAGR) of 32% projected for the period from 2023 to 2028. The e-Grocery segment has witnessed substantial growth in the number of active users, surging from 12 million in 2019 to 23 million in 2022, with expectations to surpass 50 million by 2025.

Rise of the Online F&G Market in India

The driving forces behind this remarkable surge in the online F&G market include the rapid proliferation of internet accessibility and smartphone adoption, the increasing ease of online payments, improving enabling infrastructure for logistics across the value chain till the last mile, the evolving lifestyles of consumers and the transformative impact of the COVID-19 pandemic.

The extensive array of products available on online F&G platforms, and the competitive pricing strategies employed by key players are further swinging customers towards online retail.

The online F&G sector primarily operates through two thriving models: the hyperlocal/quick commerce and the marketplace model. In the hyperlocal model, also known as quick commerce, companies like Blinkit, Zepto, BB Now, and Instamart play pivotal roles. These platforms provide quick local delivery, catering to the immediate needs of consumers within specified vicinity. These platforms either operate through dark stores or through partnerships with retail stores in each locality they service. Generally, they offer a limited assortment, about 2200- 3000 SKUs, and delivery timelines are a few minutes to a few hours at the outset. Quick commerce players largely cater to last-minute or unplanned purchases and adopt a cluster based model for expansion players and delivery is within a few hours to a few days. Marketplaces largely cater to the planned purchases

In between these two models, and swinging more towards marketplaces are models like Milkbasket, Otipy, Supr Daily etc. which offer morning delivery, the order being placed by the previous midnight. These players also aggregate products in their own warehouse and then deliver the orders placed by the customer

Geographic Distribution of Online F&G Retail

In the year 2022, almost 95% of the online F&G sales came from metros and Tier 1 cities. The southern region of India emerged as the dominant force, commanding the highest share of revenue at 33%. The Southern states also steered India when it came to modern F&G retail adoption and driven by their young IT workforce, with Bengaluru and Chennai being cities with the densest population of digital consumers, also leads when it comes to online F&G retail adoption.

The flourishing of this territory can also be attributed to the presence of prominent industry gaints like Bigbasket and Amazon and that most concept testing starts in these states. Among the cities in South India, Bigbasket reigns supreme as the go-to online F&G platform, particularly in Hyderabad and Bangalore

In second place, the Western region of India commands a 30% share of revenue and is poised for rapid growth, with a projected CAGR of 37.3%. This remarkable surge is primarily fueled by the increasing adoption of online F&G platforms among tech-savvy millennials and working women.

Notable cities in the Western region, such as Pune and Mumbai, are at the forefront of this trend. The North and East regions follow, with 25% and 12% shares of revenue, respectively.

India boasts a considerable population of working professionals who greatly prefer the convenience and simplicity of purchasing groceries online. These factors are anticipated to pave the way for substantial expansion within the online grocery market in western India, in the foreseeable future.

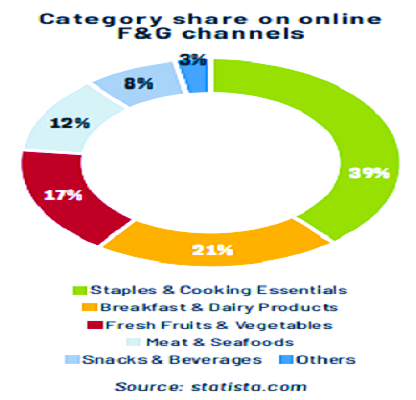

Category Share in Online F&G Retail

Online F&G platforms feature a range of product categories, with Staples and Cooking Essentials emerging as top-selling categories. These are closely followed by Breakfast & Dairy Products, among others. Notably, these platforms have expanded their offerings beyond groceries and begun to onboard and sell additional categories such as beauty and personal care products.

Expanding the Reach in Tier 2 and Tier 3 cities

In a bid to tap into the significant growth potential in smaller towns and cities, online F&G platforms have increasingly expanded their reach to tier 2 and 3 cities, building infrastructure and capabilities to cater to these markets. By offering a wider range of products and services in these areas, they aim to capture the untapped market potential and cater to the needs of consumers outside major metropolitan areas

To ensure a steady supply of quality products and promote local and sustainable sourcing practices, online F&G platforms have also embarked on partnerships with FMCG brands and farmers. These collaborations not only benefit the platforms by guaranteeing a constant supply of highquality products but also support local economies and contribute to sustainable agricultural practices. Also, seeing the growth in the online

F&G retail, new players like Jiomart entered the market during this phase. Many like Dunzo, Swiggy, etc. pivoted from other models to F&G retail.

While the online market is still evolving, with various models currently in play, the landscape is expected to resemble existing offline formats, potentially surpassing or enhancing them:

Full-basket Offerings: Comparable to supermarkets, exemplified by players like Bigbasket. They offer extensive assortments, same-day delivery (often within a few hours), precise delivery slots, and competitive pricing on essential items.

Instant Delivery: This mirrors convenience stores and small supermarkets in the online realm. Firms like Blinkit & Zepto cater to customers ordering smaller baskets from a more focused selection. The emphasis here is on speed and user experience, especially for immediate, unplanned needs. Instant players are also broadening their offerings, including (warm) meals to capture a larger share of consumer spending and branching into take-out options from restaurants or meal delivery providers.

No-frills Offerings: The online discounters, represented by companies like Amazon fresh & Flipkart supermarket offer low minimum order values and waive delivery fees, prioritizing affordability in product pricing. However, customers may need to accept trade-offs in terms of assortment variety, delivery options, and additional services.

The online F&G platforms face some challenges, as follows:

1. Growth Beyond “Convenience” Driven Customers: Over 95% of the current online F&G sales are from Metros & Tier 1 cities and largely from convenience driven consumers, who do not care about getting some extra discounts or deals, trading it for time and convenience. However, given that a predominant part of India’s population lives outside these cities and in rural areas, the F&G platforms will have to expand to smaller markets where more price-sensitive customers reside. This is a double whammy. Firstly, since the customers are more price conscious and buy only on offers and discounts, overall the gross margins on consumers basket in these cities will be lower. Secondly, the cost of operations, in smaller and more remote markets will be relatively higher.

2. Minimizing Storage and Delivery Costs: Ecommerce is most suitable for products where price is high and weight/volume of the product is low, so that storage and delivery costs are low. F&G, in most cases, falls at the other end of the spectrum, where product weight/ volume is proportionally high and price us relatively lower than other categories. Minimizing storage costs and delivery expenses is hence crucial for profitability. This requires optimizing warehouse operations, exploring cost-effective transportation and packaging options, implementing dynamic pricing strategies and promotions, maintaining a minimum basket size/value for free delivery and optimizing delivery operations.

3. Ensuring Freshness of Edible Items till Customer’s Doorstep: Maintaining the quality and freshness of perishable items during the delivery process is a significant challenge. While brick-and-mortar retailers need to maintain freshness only till the products are in their stores, online platforms need to keep the products fresh till the goods are delivered to the customer’s house and there could be a substantial time gap between shipment from the warehouse/ dark store to delivery at customer’s doorstep. This necessitates robust supply chain management, effective packaging solutions and potentially leveraging technologies like refrigerated transportation. All this not just requires effort but also additional costs.

4. Squeezing Delivery Timelines: Timely and efficient deliveries are paramount to customer satisfaction and one of the key drivers to why consumer’s shop online. This challenge involves managing required inventory levels across multiple warehouses/ dark stores, managing a fleet of delivery boys, optimizing route planning, and possibly exploring advanced technologies like drones or autonomous vehicles for last mile delivery.

5. Higher Inventory Spoilage: Preventing food spoilage and

minimizing waste is a challenge for all retailers, but more so for online F&G platforms, as there are delivery related damages and losses as well.

6. Delivery Failures & Return Rates: Online F&G platforms see 12-15% failed deliveries and return rates, something that is not there in brick & Mortar stores. The cost of this reverse logistics could be more than the cost of the product in many cases. Thus for small value items, most F&G retailers will give a refund and may not even pick the product back.

7. Catering to Non-Tech Savvy Customers: Online platforms must fi nd ways to accommodate customers who may not be familiar with technology. This could involve providing extremely user-friendly interfaces, offering customer support, and conducting educational initiatives to bridge the digital divide.

8. Cultivating Customer Loyalty: Building and sustaining customer loyalty in an online environment is extra challenging due to the plethora of options available to consumers. Most consumers shop from multiple platforms and since it is extremely easy to compare prices, offers, delivery timelines etc. consumers tend to compare and shop from the platform that gives the best offers. Establishing personalized experiences, offering loyalty programs, and providing excellent customer service are vital strategies, besides the “hygiene” of offering the best prices

9. Intensifying Competition in the Online F&G Space: The online F&G sector is becoming increasingly crowded, making it challenging for new entrants to establish their presence. The competition is not just from other online platforms but also from the online arms of modern F&G chains.

Established players dominate the market, and breaking into this space requires innovative strategies and a distinctive value proposition. New entrants need to identify and cater to specific niches or underserved markets to gain a foothold. Additionally, partnerships and collaborations can be instrumental in creating a competitive edge

10. Balancing Profitability with Customer Expectations: With the competitive nature of the online F&G business, maintaining profitability while meeting customer expectations for affordability and convenience can be a delicate balancing act. Offering competitive prices without compromising on quality and service is a persistent challenge. Implementing efficient cost-management strategies and exploring innovative revenue streams, such as subscription models or private labels, can help strike the right balance.