India’s health and wellness (H&W) food and beverage sector is witnessing a remarkable story of growth unfold in recent years. Over the past five years, this industry has surged ahead in India, eclipsing the progress of the broader Asian market, with a remarkable 7.7% Compound Annual Growth Rate (CAGR). What lies on the horizon is even more captivating, with forecasts projecting an 8.8% CAGR from 2021 to 2026, promising sustained growth.

Over the past five years, the health and wellness (H&W) food and beverage industry in India has experienced significant growth, boasting a 7.7% Compound Annual Growth Rate (CAGR). This outpaces the sector’s growth in the rest of Asia. Notably, in 2021, the sales of health and wellness food and beverages reached an impressive US$10.3 billion, catapulting India to the 15th spot on the global health and wellness market ranking. Forecasts indicate continued acceleration, with an expected 8.8% CAGR from 2021 to 2026.

Health and wellness beverages have been steadily gaining market share in India. In 2016, they accounted for approximately a fifth of the total health and wellness food and beverage market, and by 2021, they claimed just over a quarter. Projections suggest that by 2026, they will represent more than a third of the market.

The dominance of Fortified/ Functional category: In 2021, the Fortified/ Functional (FF) category dominated the health and wellness beverage market in India, while in the packaged food category, it came second only to naturally healthy (NH) food. However, naturally healthy packaged food surpassed fortified/functional packaged food in growth from 2016 to 2021.

Due to its robust projected growth, naturally healthy beverages are poised to surpass fortified/ functional beverages by the end of 2026, although the latter will continue to be the second-largest market category for both packaged food and beverages

Key market players: The fortified/ functional packaged food market in India is marked by a high degree of concentration, with the top three companies holding a combined market share of 57.2% in 2021. The concentration is even more pronounced in the beverages sector, where Unilever, due to its acquisition of the Horlicks meal replacement and Boost energy drink brands, holds a commanding 51.9% market share.

The subsequent two companies, Mondelez and Red Bull, have a combined market share of 18.6%, establishing that the top three fortified/functional beverage companies control a significant 70.5% market share.

Market characteristics: Companies seeking to enter the Indian market should take note of its unique characteristics. Most fortified/functional food and beverage products are distributed through independent small grocers. Moreover, India employs a mandatory labeling system to distinguish between vegetarian and non-vegetarian products. New product launches prominently display the vegetarian green dot.

Components of health and wellness industry: Health and wellness (H&W) encompass organic food and beverages, fortified/ functional (FF) food and beverages, naturally healthy (NH) food and beverages, better for you (BFY) food and beverages, and food intolerance products.

Growth and composition of the health and wellness sector: The health and wellness sector in India has been consistently on the rise over the past five years. India’s growth has surpassed both the Asia-Pacific region and the global growth rates. In 2021, India’s health and wellness market registered a year-over-year growth of 5.75%, while the Asia-Pacific saw a 3.74% growth, and the global market grew by 1%.

Euromonitor’s data positions India as the 15th largest health and wellness market globally in 2021, ranking just below Indonesia and ahead of the Netherlands. Given India’s vast population, there remains ample room for further market expansion.

Composition of packaged food and beverages: Packaged foods accounted for 73.3% of the Indian health and wellness market in 2021. The most significant segments within packaged food were naturally healthy and fortified/ functional products. Among them, organic food experienced the fastest growth, while naturally healthy foods showed the largest value growth within packaged food products.

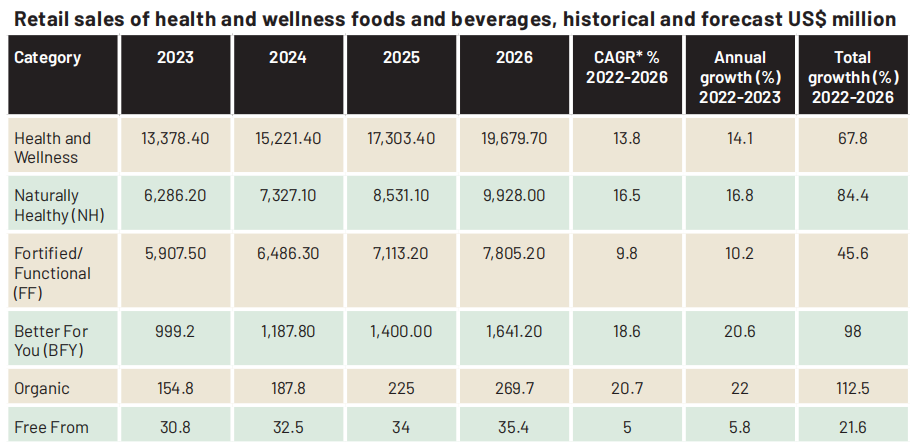

*CAGR: compound annual growth rate

Market categories and concentration: Beverages constituted 26.7% of the overall health and wellness market in 2021, marking an increase from 20.6% in 2016. Naturally healthy and fortified/functional products were again pivotal segments within this category. Naturally healthy beverages, with a 19% CAGR from 2016 to 2021, stood out as the second-fastest growing segment, just trailing organic beverages. Furthermore, naturally healthy beverages are projected to maintain their status as the fastest-growing segment through 2026.

The sales of fortified/functional packaged food reached US$3.3 billion in 2021, up from US$2.5 billion in 2016. The category of snack bars experienced the highest growth rate, although it was the smallest market within this sector.

Within the fortified/functional packaged food category in India in 2021, vegetable and seed oil emerged as the largest segment. It exhibited steady growth at a 4.9% CAGR between 2016 and 2021 and is expected to maintain this trajectory with a 4.0% CAGR through 2026.

In 2021, functional/fortified dairy took the position of the second-largest category in the Indian packaged food sector, with a total value of US$612 million. Notably, 77% of this category consisted of powdered milk. Dairy experienced a remarkable 11.2% CAGR from 2016 to 2021, with yogurt standing out as the fastest-growing segment, growing at an impressive 18.1% CAGR. The dairy category is projected to continue its growth through 2026, with the primary contributors being milk and yogurt, while powdered milk is anticipated to grow at a 2.2% CAGR.

Fortified/functional baby food, which recorded a 5.8% CAGR from 2016 to 2021, solely consists of milk formula. Although fortified/ functional breakfast cereals exhibited slow growth from 2016 to 2021, forecasts indicate more than a twofold increase in market size through 2026. This trend is expected to outpace the constant-value growth for breakfast cereals as a whole, reflecting Indian consumers’ increasing desire for healthier and more nutritious options (Euromonitor, January2023).

In India, fortified/functional beverages grew slightly more slowly than their packaged food counterparts from 2016 to 2021, and this trend is projected to continue through 2026.

The entire functional/fortified hot beverage market in India consists of plant-based and malt-based hot drinks, constituting 82% of the category in 2021. This segment has experienced growth in line with the overall market. Sports drinks, while the fastest-growing functional/ fortified category, remained the smallest in 2021.

In contrast, the functional/fortified energy drink market is twice the size of the functional/fortified sports drink market, but it has not seen significant growth between 2016 and 2021, nor is it expected to grow through 2026. Consequently, functional/fortified sports drinks are anticipated to be only slightly smaller than functional/fortified energy drinks in 2026.

The concentrates subcategory of functional/fortified soft drinks experienced slight growth from 2016 to 2021 and is expected to grow at a slightly faster rate through 2026. This growth can be attributed to an increase in powder concentrates sales, offsetting the decrease in liquid concentrate sales. This shift from liquid to powder concentrates is projected to persist through 2026.

Market dynamics and distribution channels: In India, nearly all functional/fortified food and beverages are retailed through grocery retailers, primarily traditional grocery stores. E-commerce did experience substantial growth from 2016 to 2021 but still accounts for a relatively small portion of the market compared to store-based retailing

Functional/fortified foods and beverages were primarily distributed through store-based retailing, which constituted 88.7% in 2016, slightly decreasing to 88.3% in 2021. Non-store retailing, on the other hand, increased from 11.3% in 2016 to 11.7% in 2021. E-commerce recorded the fastest CAGR growth at 3.2% in actual retail value or 2.9% in percentage table from 2016 to 2021, reaching US$985.6 million in 2021.

Frontrunners in the health and wellness market: In 2021, the leading companies in the functional/fortified packaged food category were Britannia Industries (22.9%), Cargill (19.4%), and the Gujarat Co-operative Milk Marketing Federation, marketing its products under the Amul brand name, with a 14.9% market share. Britannia specializes in biscuits and baked goods, while Cargill’s primary brands are packaged oil products. Other notable international companies in the functional/fortified packaged food category include Nestlé (8.4%) and Kellogg (4.7%)Unilever took the lead as the top functional/fortified beverages company in India from 2019. Its acquisition of the Horlicks and Boost brands from

GlaxoSmithKline in December 2018 significantly bolstered its position. Horlicks alone accounts for 40% of the Indian functional/ fortified beverages market, with an additional 10% attributed to Boost. Prior to these acquisitions, Unilever played a minor role in the Indian functional/fortifi ed beverages market, with its flagship product being the Kissan-brand juice, holding approximately a 2% market share.

The sector is notably concentrated, with eight companies capturing 82% of the Indian market, leaving no room for another company to claim a statistically significant market share. As a result of these acquisitions, Unilever experienced an impressive 107% CAGR from 2016 to 2021.

Product launch trends: According to Mintel’s Global New Products Database (GNPD), between January 2018 and December 2022, there were 8,961 launches of functional food and beverage products in India. Of these, 6,084 were functional food products, and 2,877 were functional beverages. Notably, the number of new packaged food launches is increasing, while the number of new functional beverage launches is decreasing.